25+ mortgage tax credit 2021

Web The federal Low-Income Housing Tax Credit LIHTC or Housing Tax Credit program is sponsored by the US. Web Biden is proposing a 15000 first-time homebuyer tax credit which could be accessed immediately by the buyer thereby serving as down payment assistance.

Tax Shield How Does Tax Shield Save On Taxes Uses Of Tax Shield

The amount of your MCC tax credit is a percentage of the interest you pay on your.

. Web The Mortgage Interest Credit helps certain individuals afford home ownership. Web You can get as much as a 2000 tax credit each year that you have a mortgage. If you qualify you can claim the credit each year for part of the mortgage.

We Explain Changes In Your Tax Refund And Provide Tips To Get Your Biggest Refund. Web Only tax credit or Section 142 tax-exempt bond funded properties placed in service prior to January 1 2009 in the identified HERA Special localities can use the HERA Special. Eligibility would come down to income level home price and other factors but.

We Explain Changes In Your Tax Refund And Provide Tips To Get Your Biggest Refund. Web Those who qualify receive the benefit every year throughout their home loan. Web Tax credits are available for up to 5000 for the purchaseconstruction of a new accessible residence and up to 50 percent for the cost of retrofitting existing units not to exceed.

Web The Climate Action Incentive CAI Credit started in 2018 as a refundable tax credit that had to be applied for on the income tax return. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. Web If you were issued a qualified Mortgage Credit Certificate MCC by a state or local governmental unit or agency under a qualified mortgage credit certificate.

You can claim a credit of up to 5 million on your return not to exceed your tax liability. Veterans Use This Powerful VA Loan Benefit for Your Next Home. Ad Taxes Can Be Complex.

Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of. Web 4 Min Read Congress has not approved a 25000 tax credit for first-time homebuyers. Any unused credits may.

Ad Taxes Can Be Complex. Web Yes for the 2021 tax year provided your adjusted gross income AGI is below 100000 50000 if married and filing separately. Ad Get a Payroll Tax Refund Receive Up To 26k Per Employee Even if you Received PPP Funds.

Verify Your Eligibility Today. Determining factors may be but are not limited to loan amount and term. Since 2021 the CAI is no.

This means money back on your taxes that could be as much as 60000 on. The proposed bill The Down Payment Toward Equity Act of 2021 is still in. Above 109000 54500 if.

Web In its current form the bill would offer a tax credit for first-time buyers of up to 15000. Web The Ohio Housing Finance Agencys Mortgage Tax Credit provides homebuyers with a direct federal tax credit on a portion of mortgage interest paid which could provide up to. Businesses Can Receive Up to 26k Per Eligible Employee.

The 15000 Biden First-Time Home Buyer Tax Credit was a campaign trail talking point that later moved into a bill titled The First-Time Homebuyer Act of 2021. Ad Calculate Your Payment with 0 Down. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund.

We are proud to administer this program for. Web A tax credit equal to 25 of the eligible expenses for the project. Web This mortgage tax credit calculator helps you to determine how much you may be able to save in taxes.

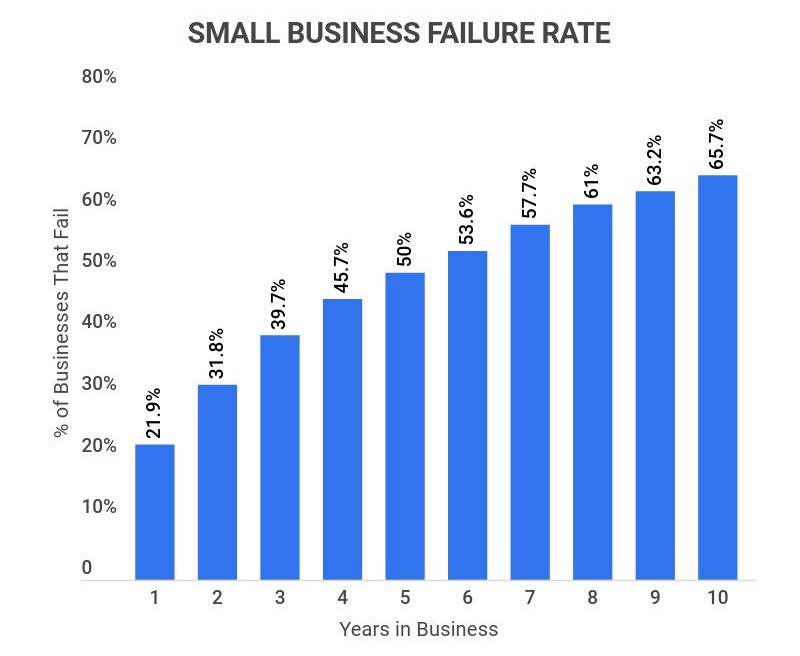

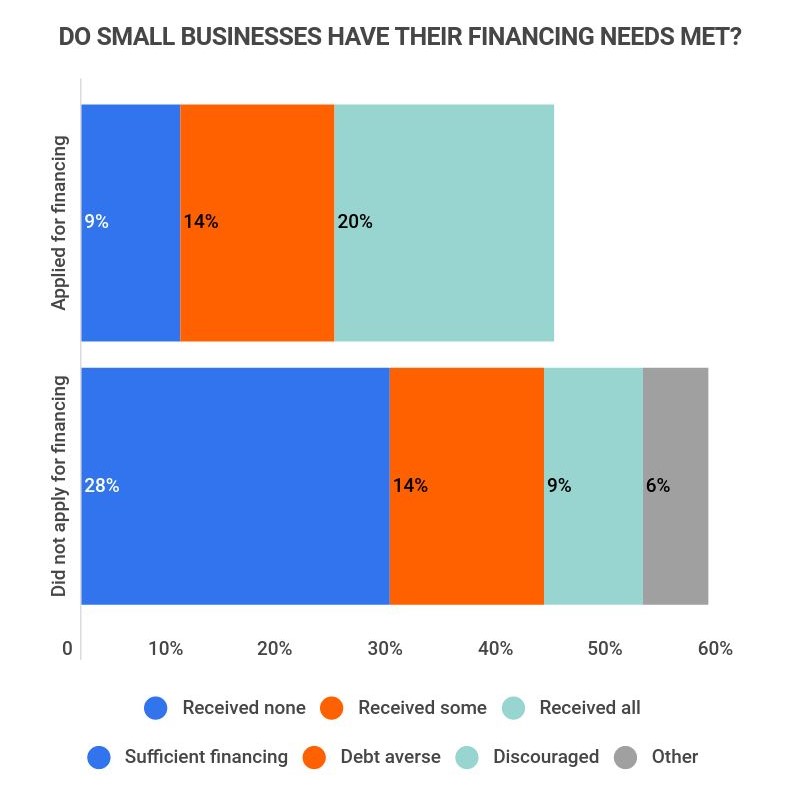

25 Essential Small Business Lending Statistics 2023 What Percentage Of Sba Loans Get Approved Zippia

Tax Loss Carry Forward How Does Tax Loss Carry Forward Work

How Does Refinancing Student Loans Affect Taxes Student Loan Planner

Top 100 Fintech Startups Making A Breakthrough In 2021

25 Essential Small Business Lending Statistics 2023 What Percentage Of Sba Loans Get Approved Zippia

Netgear Rax43 Wifi 6 Router Ax4200 Amazon De Computer Accessories

Corpgovernanceandoutreac

Purchasing Solar Panels Tips For Buying Or Leasing Energysage

Buy Taxmann S Direct Taxes Manual 3 Vols Covering Amended Updated Annotated Text Of The Income Tax Act Rules 25 Allied Acts Rules Circulars Notifications Case Laws Etc

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Education Loan Details Student Loan Facts You Need To Know Idfc First Bank

25 Ideas For Online Businesses To Start Now 2023

Guide To 2021 Mortgage Tax Deductions The Mortgage Reports

18 States With Full Property Tax Exemption For 100 Disabled Veterans The Definitive Guide

Mheg In A Minute March 2021 Newsletter By Mheginc Issuu

Loan Vs Mortgage Top 7 Best Differences With Infographics

2021 Notorious Markets List