15+ generations auto loan rates

Similarly millennials now show. Rates are subject to change without notice.

Auto Loan Rates As Low As 1 99 Apr We Care About Our Members And Want You To Stay Safe This Holiday Season If That Means A New Safer Car For Your

Financing a vehicle can feel a bit like ordering off one of those 15-page bulky restaurant mega.

. Increase your cash flow with a competitive auto loan rate and no payments up to 90 days. The average monthly car payment for a diesel-fueled vehicle is 860. Because when you finance a car it is a secured loan they tend to come with lower interest rates than unsecured loan options like personal loans.

Fawn Creek has seen the job market decrease by -09 over the last year. Rates last updated October 24 2022. Your Annual Percentage Rate is determined by several factors including your credit history and.

All of our decisions are made right here in Olympia. The average auto loan rate was. When it comes to the largest increase in their bills Gen Zs auto loan payments jumped 92 year over.

Weve compiled a list of eight lenders that currently offer the best auto loan rates for both new and used cars. Apply online today at Bank of America. Because youll pay off the.

Millennials those born between. View and compare current auto loan rates for new and used cars and discover options that may help you save money. In 2019 before the pandemic began Gen Z had a past-due rate of 175.

Gen Z which includes those born in 1995 and after has a past-due rate of 221 percent compared with 175 percent before the pandemic. The annual BestPlaces Health Cost Index for the Fawn Creek area is 947 lowerbetter. The average monthly car payment for a hybrid vehicle is 529.

Thats compared with 547 for millennials and 429 for Gen Z on average each month. Youll pay off the mortgage in 15 years. Boat RV Motorhome Loan.

Today past-due rates have reached as high as 221 among Gen Z car owners. 110 10 more expensive than. The speedy and easy internet financing.

Fawn Creek has an unemployment rate of 47. The US average is 60. Heres how it works.

The US average is 100. Economy in Fawn Creek Kansas. As of September 8 2022 the.

Save money over the course of your loan with a lower interest rate and pay off your mortgage faster. We can help you drive away with a new or used automobile truck SUV or motorcycle. From your first credit card account to refinancing your home Generations makes it easy and affordable.

Here at BTE Financial we strive to always be your main resource with regard to personal loans in Fawn Creek KS no matter your credit rating.

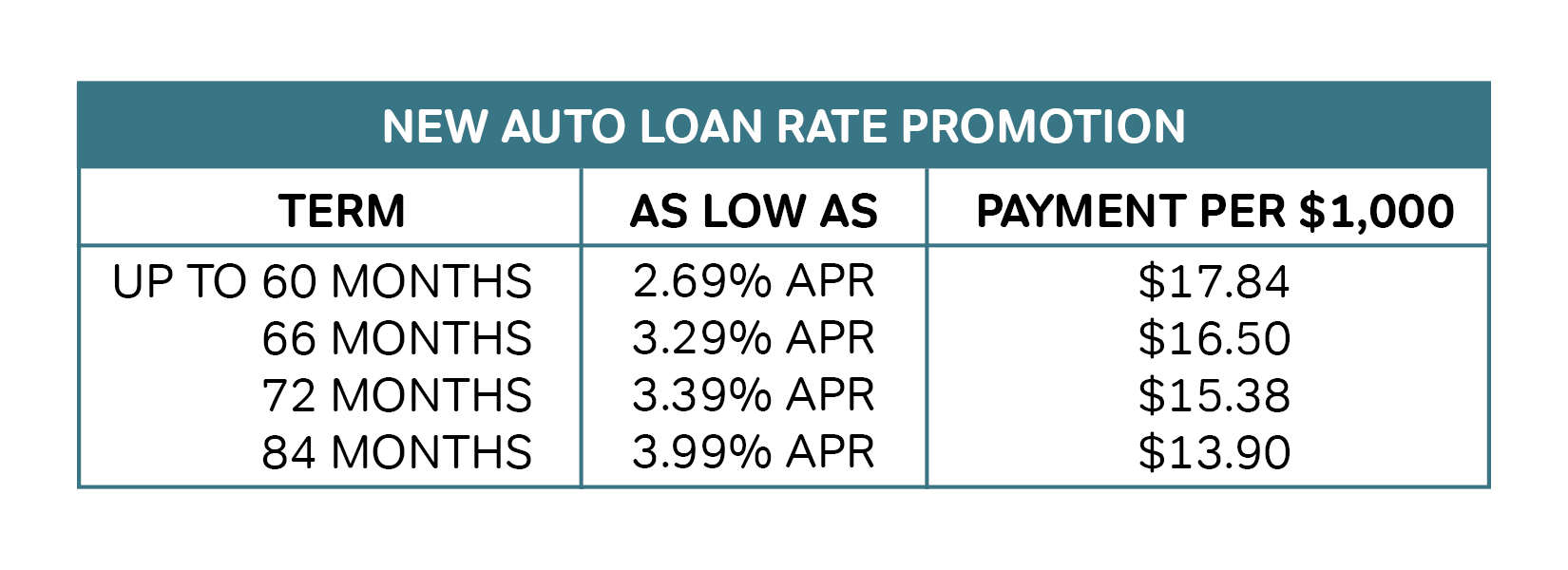

New Auto Loan Rate Promotion Members First Credit Union

Qa Systems The Software Quality Company Stuttgart

Chart Over 100 Million Americans Have Auto Loans Statista

Sec Filing Biontech

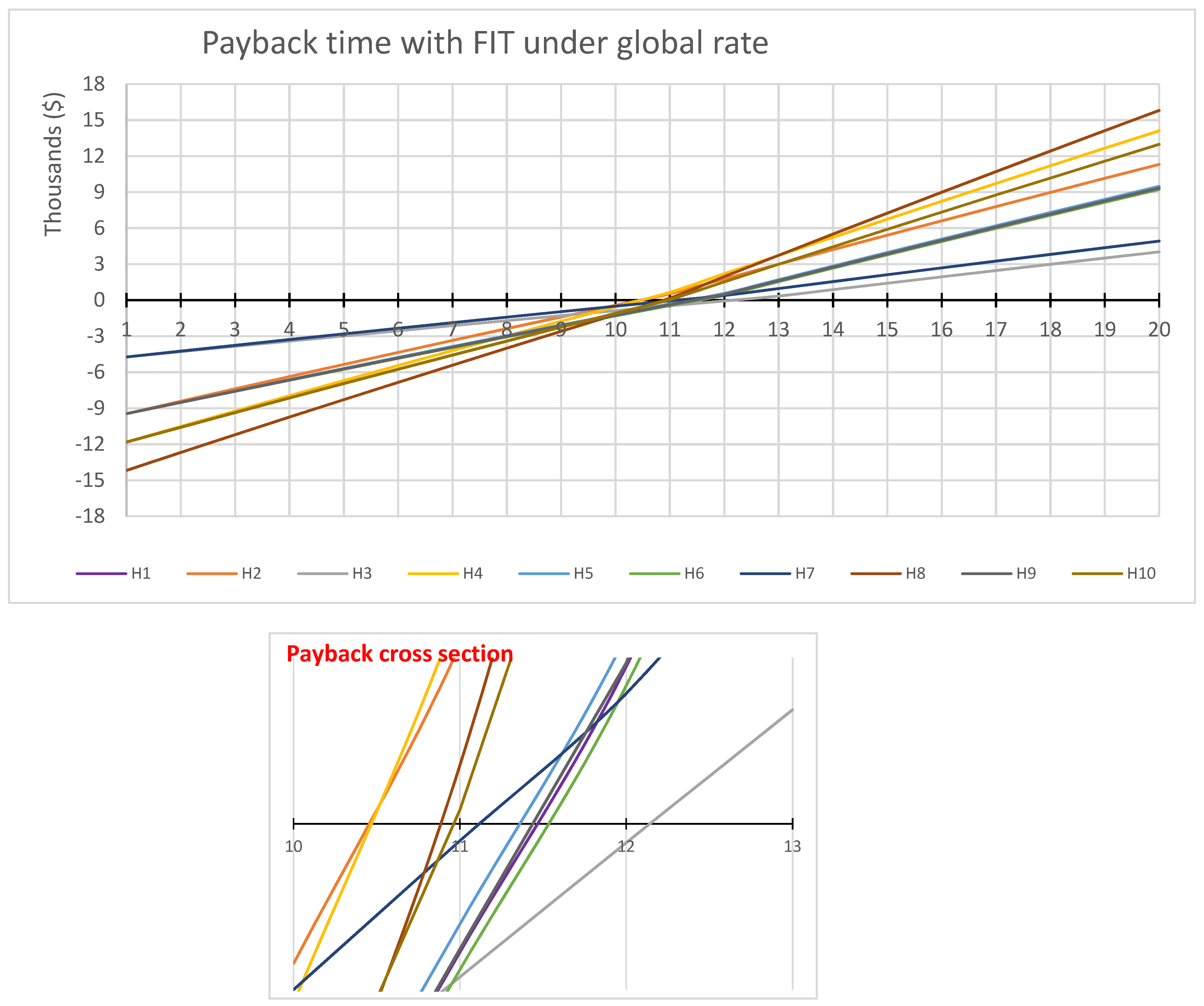

Energies Free Full Text Economic Viability Of Rooftop Photovoltaic Systems And Energy Storage Systems In Qatar Html

Blog Fintech Forum Europe Since 2013 Award Winning Insights On What S Next In European Fintech From The Startups Investors And Financial Institutions Making It Happen

How Auto Loans Compare By Generation

Foreign Issuer Report 6 K

New Used Refinanced Car Loans Genisys Credit Union

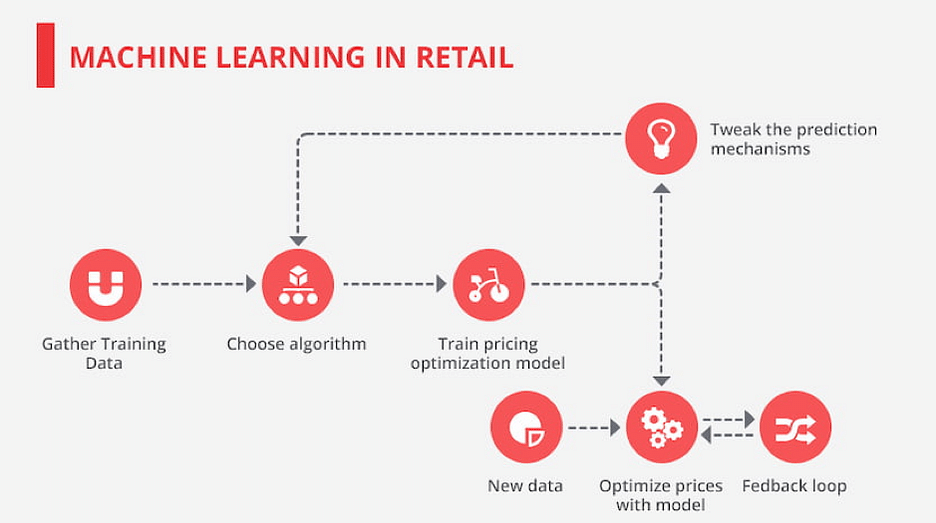

Top 50 Machine Learning Projects Ideas For Beginners In 2022

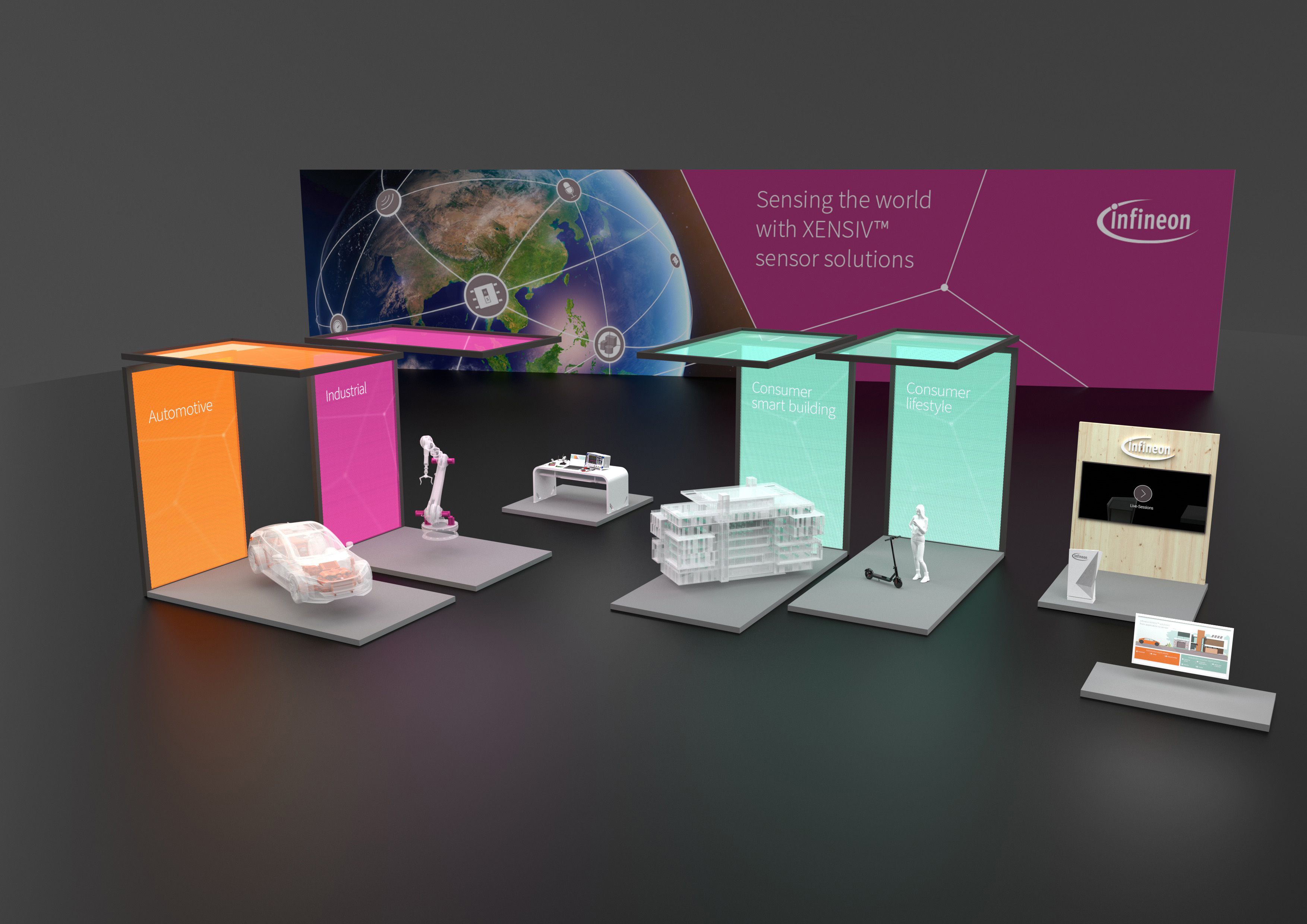

Virtual Sensor Experience Infineon Technologies

Top Mortgage Statistics For 2022 Rocket Mortgage

Fixed Auto Loan Credit Union Vehicle Financing Gfcu

:max_bytes(150000):strip_icc()/My_Auto_Loan-fd92eb924dbc49f2b7673a4fa2e6cfba.jpg)

Best Car Loan Rates Of November 2022

1 Key Policy Insights Oecd Economic Surveys Latvia 2022 Oecd Ilibrary

Qa Systems The Software Quality Company Stuttgart

Kalyani Motors Startseite Facebook